The Board is aware of its role, duties, and responsibilities towards the Company and its shareholders, and has already approved written policies pertaining to supervision and monitoring of its operations. Criteria and operating guidelines have been set, in line with the Principles of Good Corporate Governance of the SET to support the Good Corporate Governance in practice. Moreover, the Company must comply with the various rules and regulations prescribed by the SEC and the SET in every respect, and review its governance policies and evaluate the result pursuant to those policies at least once a year.

The Company has policies on the supervision of its operations, which will be used as guidelines. They can be divided into sections, as follows :

Code of Conduct

Articles of Association

A Declaration of Intent

Sustainable Management in the Environmental Dimension

Sustainable Management Policy and Goals

Human Rights Policy

The Supervision of Subsidiaries and Associated Companies Policy

Board of Directors

The Company focuses on providing efficient services, developing our personnel to support the services and expanding investment to other high potential countries in the region, under a transparent and accountable management pursuant to the principles of Good Corporate Governance. To realize this vision, the Board strives to maintain the highest ethical standards within the framework of the law, the Company’s objectives and its Charter as well as resolutions adopted at shareholder meetings with commitment, honesty, integrity, and prudence in line with good operating practice so as to deliver highest economic value to the Company and maximum stability to shareholders.

The Company’s Board of Directors comprises people who have knowledge, skills, and experience drawn from a variety of professions in the areas of PC games, online business, finance, marketing, law, management, IT, and other fields beneficial to the Company’s work. The Board is free to decide in the best interests of the Company and its shareholders overall. This Board has played a part in determining (or approving) the Company’s Vision, Mission, Strategies, Targets, Business Plans, and Budgets, as well as supervising the performance of its management to ensure effective implementation of the Business Plans and Budgets for the greatest economic benefit for the Company and maximum stability for the shareholders. Action has also been taken to ensure that there is a process for regular evaluation of the adequacy of internal control, internal audit, risk management, financial reporting, and follow-up of performance.

Currently, the Company’s Board of Directors comprises 6 members, 1 executive and 2 non-executive, and 3 are non-executive and independent directors which, therefore, exceeds one-third of the Board thereby giving an appropriate balance vis-a-vis executive directors. The Board has set up two sub-committees to help supervise operations of the Company, i.e. the Executive Committee and the Audit Committee which consists of three independent directors with a term of office of up to three years. The duties and responsibilities of those Committees have been expressly defined at previous shareholder meetings.

The Board is aware of the roles, duties, and responsibilities of guiding the operation. Monitor and supervise the work of the management. Perform duties with knowledge, ability, transparency, care, and responsibility in performing duties (Accountability) of the Board of Directors towards the Company and shareholders, independent from the management. There are essential guidelines as follows:

Board of Directors Qualifications

- Possess the qualifications, and have no prohibited characteristics, according to the Public Limited Companies Act B.E. 2535 or other relevant laws, including the rules and regulations of the SET and the SEC and the Company’s article of association.

- Be qualified, knowledgeable, and capable. Have an experience that is beneficial to the business operations of the Company.

- Have leadership, vision, and independence in making decisions for the Company’s best interest and shareholders as a whole.

- Have a responsibility to perform director duties and devote their time to serving the duties fully and being responsible to the shareholders regularly (Accountability to Shareholders) and make decisions with caution (Duty of Care) to protect the interests of the Company.

- Perform duties with integrity and ethics within the law framework and guidelines for good corporate governance and code of business conduct.

The Board of Directors is aware of its role and responsibility in guiding the direction of operations, following up on and supervising the work of the management department, and performing duties with knowledge, ability, transparency, caution, and responsibility (Accountability) of the Board of Directors towards the company and shareholders. It operates independently from the management team and adheres to important guidelines as follows:

The Chairman of the Board

- Acts as the Chairman of the board, shareholders, and non-executive meetings.

- Call the Board of Directors meeting or appoint another person to perform this duty.

- Encourage all board members to debate issues vigorously during meetings, ask questions, and express opinions.

- Cast a decisive vote, in case the casting vote in the Board of Directors meeting are equal.

Roles and Duties of the Chairman of the Executive Committee

- Utilize leadership to ensure the Executive Directors’ efficient performance of duties for the best interests of the Company and independent from the management.

- Consider and approve the agenda of the meeting proposed by the Company Secretary to make the agenda consistent with the duties and responsibilities of the Executive Committee.

- Supervise the Executive Directors in implementing the Board of Directors’ policies to implement them to achieve results.

- Oversee and encourage the Executive Committee to abide by good corporate governance principles and the Company’s code of business conduct.

Term of Office of Directors

- At every annual general meeting, one-third (1/3) of the number of the directors shall retire from the office. If the number of directors can not be divided exactly into three parts, the number of directors nearest to one-third (1/3) shall retire from office.

- The directors who retire from office in the first and second years following the registration of the Company shall be drawn by lots. In every subsequent year, the directors who have been longest term in office shall retire. A retired director may be eligible for re-election.

The Director Election/Appointment

- Election of directors to replace those who are due to retire by rotation must seek approval from the shareholders’ meeting.

- In the event that a position of director becomes vacant for any reason other than the end of his office term, the Board of Directors shall on the next board meeting appoint a qualified person, not having unacceptable qualities under the laws as the replacement, unless the remaining duration of the director's term of office is less than 2 months. The replacement director shall hold office only for the remaining term of office of the director whom he replaces. The resolution of the Board of Directors pursuant to the first paragraph must be approved by the votes of not less than three-fourth (¾) of the number of the remaining directors.

Board Independence from the Management, Guidelines for the Board Independence from the Management

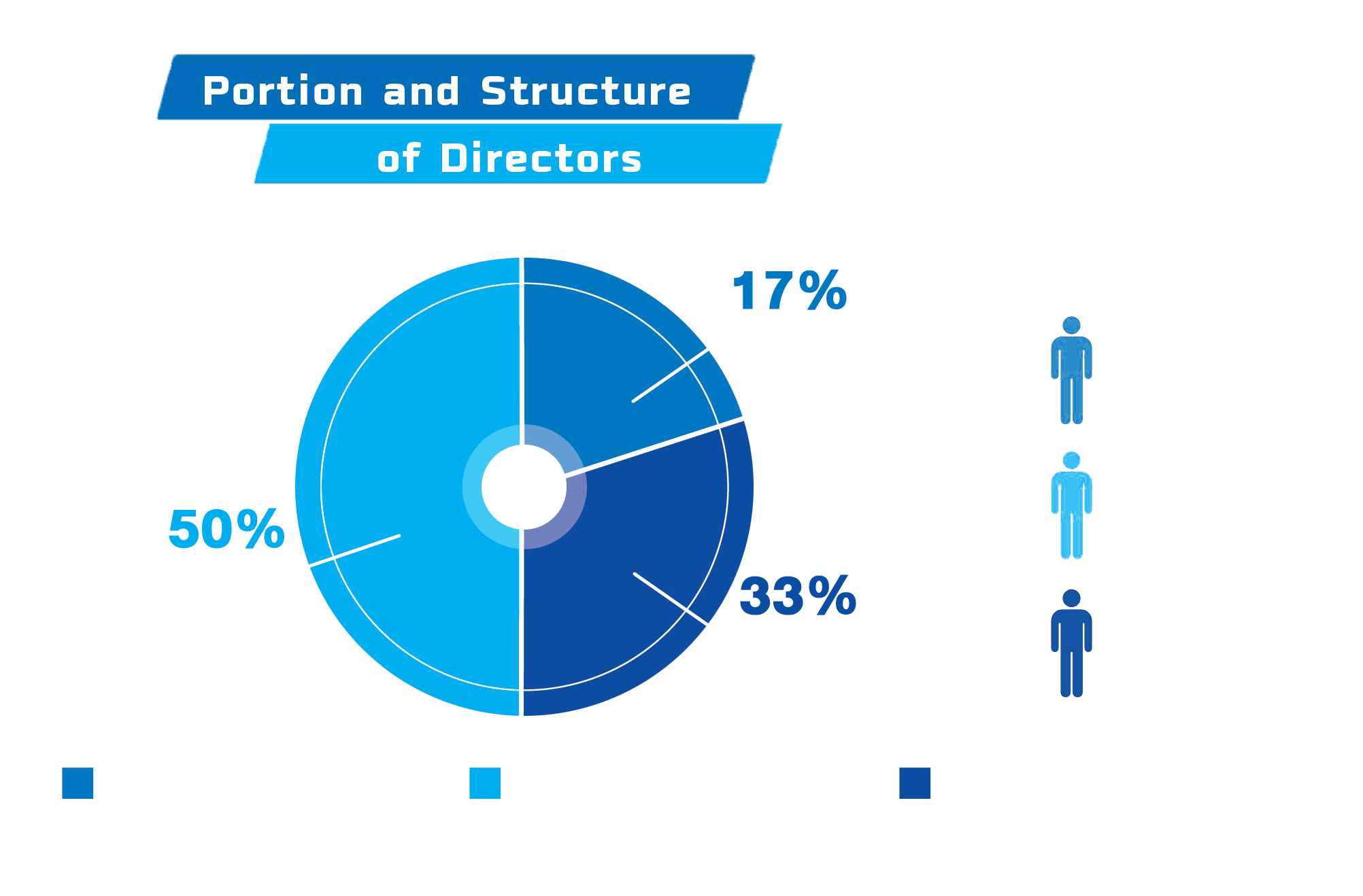

The Board of Directors structure comprised 3 non-executive and independent directors, 1 executive director, and 2 non-executive directors. As of 31 December 2024, the Company had five members of the Board of Directors. The balance of power by non-executive directors was as follows :

- Executive director: 1 person (17%)

- Non-executive and independent directors: 3 persons (50%)

- Non-executive director: 2 persons (33%)

Nomination of the Directors

Currently, the Company has no Nominating Committee for selecting directors. This matter is therefore left to the Board, which will select individuals and propose them to the shareholders based on a variety of factors such as their educational background, competencies and business experience. They must also be qualified under the Public Limited Companies Act, B.E. 2535, Notification of the SEC and other relevant laws. Director selection will be made by majority vote at shareholder meetings in accordance with the following criteria and procedure:

- A shareholder will be entitled to one vote for each share.

- The vote to select directors will be done on an individual basis.

- The person with the most votes will be selected as a director. If there is more than one vacancy, the persons with the most votes in descending order will be selected as directors. Where there is a tie, the Chair of the shareholder meeting has a casting vote.

| Business Competencies Required | Mr. Pramoth Sudjitporn | Mr. Kittipong Prucksa-aroon | Mr. Santithorn Bunchua | Mr. Teeradet Dumrongbhalasitr | Mr. Chalermphong Jitkuntivong | Mrs. Monluedee Sookpantarat | Pol.Col. Yanaphon Youngyuen |

|---|---|---|---|---|---|---|---|

| Business Management | |||||||

| Sales and Marketing | |||||||

| Legal | |||||||

| Accounting and Finance | |||||||

| Information Technology | |||||||

| Games Industry Knowledge | |||||||

| Data |

Board Diversity

The Board of Directors recognizes the interests of the diversity of the Board of Directors. It deems an important factor in enhancing the efficiency of the Board of Directors’ performance. Such diversity is not limited to only gender but also ethnicity, age, educational history, professional experience, skills, knowledge, and attitudes. Therefore, the nomination and appointment of the Company’s directors will be based on knowledge and capability, including the use of selection criteria, which considers the interests of diversity.

Development of Directors and Executives

The Orientation of New Director

The Board of Directors provided an orientation program for new directors to gain a thorough understanding of the Company’s business and management in order to prepare the directors to perform their duties.

Development of Directors and Executives

The Company will support the attendance of its Board and senior executives at training courses which will be beneficial to their performance and will enable them to exchange opinions, on a regular basis, with Board members and senior executives of other organizations. Such courses include those arranged by the Company’s employee training unit, units under the State’s jurisdiction and independent entities such as Thai Institution of Directors. It is an SEC requirement that directors of listed companies attend at least one of these courses, e.g. Director Certification Program (DCP), Director Accreditation Program (DAP), and Audit Committee Program (ACP) so that knowledge and experience gained can be used for the Company’s further development.

In 2024, there were directors and executives to attend training/seminars in the following important courses.

| Name | Training Course |

|---|---|

| Mr. Pramoth Sudjitporn Chairman |

|

| Mr. Kittipong Prucksa-Aroon Managing Director |

|

| Mrs. Monluedee Sookpantarat Independent Director and Audit Committee Member |

|

| Mr. Ung Chek Wai, Gerry Chief Financial Officer |

|

| Mr. Chawanin Tritavornyuenyong Group Accounting and Finance Director |

|

Board Performance Evaluation

To enhance the efficiency of performance by its various Committees, arrangements are made by the Company to have members of each Committee evaluate their own overall performance so that they can together appraise and look at their performance and problems. Following this evaluation, the Board will analyze their performance and determine measures which will improve the Committees’ efficacy.

Determination of Remuneration for Directors and Senior Executives

The Company has a policy of determining remuneration for its directors, both in monetary and non-monetary terms, openly and transparently. The remuneration shall be submitted for approval to the annual general meeting of shareholders. Criteria governing remuneration of directors are as follows :

- Appropriate and commensurate with the duties and responsibilities of each director.

- At a level capable of attracting and retaining quality directors with suitable ability and knowledge.

- Clear, transparent, and easily comprehensible.

- Comparable to the remuneration of directors in the same or similar industry(ies).

Determination of Chief Executive Officer Remuneration

The remuneration for executives will be determined by the Board, both in monetary and non-monetary terms, in line with the Company’s performance and each executive’s performance. They will be set at such rates as are adequately attractive to retain quality senior executives and shall be comparable to rates of other companies in the same grade or operating in the same line of business.

Succession Plan Policy of Chief Executive Officer

The Company has a plan for selecting personnel who will be responsible for all important positions to be appropriate and transparent to ensure that the Company has executives who are professional which is considered by the Board of Directors.

Directorship in Other Listed Companies

The Board of Directors has stipulated that each director can hold a directorship position in other listed companies as deemed appropriate. The director should not serve as a director in other listed companies that cause conflicts of interest with the Company and the performance of director duties.

Rights of Shareholders

The rights of shareholders covers a variety of rights such as the right to purchase, sell, or transfer shares, the right to share in the Company’s profits, the right to attend shareholder meetings, and the right to express an opinion and to participate in making important decisions in the Company. Such decisions include the selection of directors, approval of major transactions with a potential impact on the Company’s direction, and revisions of the Company’s Memorandum and Articles of Association. It is the Company’s policy to promote and facilitate the shareholders’ exercise of their various rights, by such means as follows :

- Distribute information concerning shareholder meetings on the Company’s website before sending out paper documents, and elaborating on the rights of shareholders in attending the meeting and voting.

- Where a shareholder cannot attend the meeting in person, he or she is given the opportunity to appoint an independent director or any individual as his or her proxy at the meeting by using any of the forms of proxy sent by the Company together with the convening notice for the meeting.

- Before a scheduled meeting date, shareholders are given the opportunity to send their opinions, recommendations, and questions by e-mail to the Investment Relations Officer or the Board Secretary.

- The Company will arrange an appropriate time-slot for shareholders to make their comments and recommendation or raise questions freely on any agenda item before a resolution is adopted on that item. Adequate information has already been provided to shareholders for these meetings and the Company will arrange to have available staff who are well informed in each area under question, under the Board’s supervision, to respond to any questions or doubts raised from the floor.

- All directors will attend the meeting so that shareholders may ask for further details or information on any relevant issues.

Equal Treatment of Shareholders

It is the Company’s policy to treat all shareholders equally and protect their rights in the interest of strengthening equitable treatment particularly for minority shareholders. For instance :

- Shareholders will be given equal opportunities and facilities. No action will be taken that will limit, violate or diminish their rights.

- The right to vote at meetings will be determined by the number of shares held by each shareholder at the rate of one vote for one share.

- Independent directors are assigned to take care of minority shareholders who may make recommendations, comments or complaints to them. These independent directors will give appropriate consideration to each issue. For example, in the case of complaints, they will establish the facts and decide a suitable remedy. In the case that the independent directors consider that the recommendation has significant impact on those with vested interests or on the Company’s operations in general, that issue will then be submitted to the shareholder meeting for the shareholders’ consideration.

- Shareholders will be encouraged to exercise their rights. For example, minority shareholders will be given the opportunity to add agenda items before the scheduled meeting date or to nominate directors. The agenda, however, may not be expanded without prior notice to shareholders.

- The Board has taken measures against insider trading by relevant parties including directors, executives, employees, and employees of the Company involved with that information (including the spouses and non sui juris children of those individuals).

The Company has introduced a policy and measures to prevent the use of inside information which has not yet been disclosed to the public, for personal gain and securities trading :

- Directors, executives, employees and workers within the Company must keep Company information and other inside information confidential.

- Directors, executives, employees and employees within the Company may not disclose any confidential information or other inside information about the Company, or use it for their own gains or those of others, whether directly or indirectly, and whether or not it is for compensation.

- Directors, executives, employees, and workers within the Company may not buy or sell, transfer or accept the transfer of the Company’s securities through the use of confidential or inside information about the Company, or take any other action using that confidential or inside information which would cause the Company to suffer a loss, whether directly or indirectly.

Directors, executives, employees, and workers of the Company who work in a unit which has acquired inside information should avoid buying or selling the Company’s securities for one month before disclosure of its financial statements to the public.

This provision includes the spouses and non sui juris children of directors, employees, and workers of the Company. It is a serious offense to breach this provision. - Directors and executives are required to report to the SEC any change in their holding of securities or that of their spouses and non sui juris children.

The Company will take disciplinary action against any of its directors, executives, employees, and workers who breaches or fails to comply with the Company policy. The disciplinary action begins with a written notice and is followed by salary cut(s), unpaid temporary suspension from work and dismissal from employment, depending on the severity of the offense and the provisions in the Company’s Charter informing all directors, executives, employees and workers of the disciplinary action.

Moreover, each director and executive has acknowledged in writing his or her duty to report his or her holding of the Company’s securities and those held by his or her spouses and non sui juris children, and to report any change in such holdings to the SEC and the SET pursuant to section 59 and the penalty prescribed by section 275 of the Securities and Exchange Act, B.E. 2535.

On the subject of providing supporting data to its affiliates, the Company has prescribed procedures to prevent information leaking, such as requesting a signed Confidentiality Agreement and a ban against photocopying of documents without authorization.

Besides making complete and timely financial disclosure or disclosure of other information to the public via various channels in strict compliance with the law, the Company shall also make the following disclosures to show the transparency of its operations :

- Disclosure of information concerning performance by various sub-committees such as the frequency of their meetings.

- Disclosure of guidelines in recruiting directors, relevant evaluation guidelines and evaluation of the Board’s performance.

- Disclosure of remuneration policies for directors and high-level executives as well as the form, manner and amount of remuneration received by each member of the various sub-committees.

- Disclosure of policies created for protection of the environment and in support of society, and the results of their implementation.

- Report on policies of corporate governance and their implementation.

- Opportunity for the public to raise any concern/query via the Investment Relations Officer.

- The Board of Directors shall consider related transaction that may cause conflict of interest between shareholders, directors, and the management with best prudence, integrity, reasonable ness, and independence within good business ethic framework, and disclose complete information for the best benefit of the Company. The Board of Directors shall strictly conform to the criteria and procedures or regulations set by SET and ask the audit committee to provide information about the necessity and appropriateness of such transaction.

- The Board of Directors formulated measures and approval procedure of related transaction between the Company and its subsidiaries or persons who may have conflict of interest. The persons who may have direct and indirect conflict of interest shall not be allowed to make decisions on the matter. The audit committee is required to participate in the consideration and provide opinions on the necessity and reasonableness of the items proposed for the best benefits of the Company. The board of the financial statements prepared by using the generally accepted accounting principles published in the annual report.

The Company Sets Policy on Treatment towards Intellectual Property

The Company operates business under the intellectual property law, including copyrights, patents, and other specified intellectual properties, such as using the copyright computer programs and software. For this reason, the contributions to be used in the organization must be checked to assure that those contributions will not infringe anyone’s intellectual property.

The Company Sets Policy on Treatment towards Human Rights

The Company respects the fundamental human rights which is equivalent for employees and encourages employees to have personal coequal rights, freedoms, and equivalences without violation of personal privacy. The Company has fair employment and will not participate in any performances against human rights.

The Company always attaches importance to and operates its business in accordance with the Code of Conduct, including compliance with laws and regulations related. And encouraging directors, executives and employees of the Company to realize the importance of conducting business with social responsibility, uphold the principles of honesty and transparency in addition, all stakeholders must be taken into account. In 2021, the Company established an anti-corruption policy as a guideline for executives, directors and employees in working and doing business.

In the year 2024, the Board of Directors' meeting has examined and reviewed the original policy and set a new policy to be in line with the change in the Company's business structure as follows.

- At the no.6/2567 Board of Directors meeting on 9 August 2024, a resolution was passed to amend the key elements of the Anti-Corruption Policy to align with the current circumstances. The amendment expands the policy's scope to include its enforcement in subsidiaries and adds definitions for "gifts," "entertainment and hospitality," "charitable donations," "public donations," "political assistance," and "conflicts of interest." Furthermore, the definition of "giving gifts or other benefits" was expanded to include providing commercial benefits or promoting business relationships, image, and the company's reputation. Additionally, the guidelines for communication and information disclosure were made clearer.

- At the no.8/2567 Board of Directors meeting on 8 November 2024, the company's Code of Ethics was reviewed, and a resolution was passed to amend the content related to the use of information technology and communication to ensure that company personnel have clear guidelines for proper and efficient usage.

Shareholder Meeting Quality Assessment Project

In the 2024, Annual General Meeting of Shareholders Quality Assessment Project conducted by the Thai Investors Association The result of the assessment of the quality of the Annual General Meeting of Shareholders for the year 2024, the Company received an evaluation of a “Excellent” level with a score of 99.